Individualized Truist organization debit card using your symbol or customized art in your case and any workers you select.

David Gregory is an editor with more than ten years of practical experience from the fiscal companies market. In advance of that, he worked as a youngster and household therapist until finally he produced the choice to move overseas for a number of decades to work and vacation.

Limited terms make it hard to repay the mortgage punctually. The lender may possibly offer to increase your bank loan phrase to lower your month-to-month payment, but this generally keeps the borrower in debt for for a longer period and drives up the overall price of borrowing.

In the event you’re planning to choose out a $2,000 financial loan to consolidate personal debt, fund A significant invest in or progress An additional money goal, it’s crucial that you weigh your choices.

IIIF supplies researchers rich metadata and media viewing selections for comparison of will work throughout cultural heritage collections. Pay a visit to the IIIF webpage to learn more.

Money Implications (Curiosity & Finance Prices) Eiloan is just not a lender, and we can't predict what fees and curiosity charges are going to be placed on any mortgage you may be provided. Your lender will supply all the necessary details about the linked charges of the mortgage they wish to give you.

You may benefit from a $two,000 bank loan In case you have a substantial credit score score, a very low DTI ratio, in addition to a trustworthy source of money. But Remember the fact that Simply because your mortgage is small, that doesn't signify there aren't any penalties.

You should still manage to choose out a bank loan with undesirable credit score, but you should pay an increased interest price.

All 3rd-get together names and logos are emblems in their respective entrepreneurs. These owners usually are not affiliated with GO2bank and also have not sponsored or endorsed GO2bank solutions or services.

As more info a private finance qualified in her 20s, Tessa is acutely aware about the impacts time and uncertainty have on your own financial investment conclusions. When she curates Small business Insider’s tutorial on the ideal financial investment applications, she believes that the money portfolio does not have to become perfect, it just has got to exist. A little investment decision is better than nothing, as well as problems you make along just how undoubtedly are a needed A part of the training method.Experience: Tessa’s know-how involves:

Though payday loans supply speedy usage of cash, they have extremely substantial fascination fees and short repayment terms, producing them the a lot less intelligent selection for borrowers.

Borrow against your future paycheck that has a cash advance application. These apps is often A cost-effective method to borrow a few hundred bucks, but advances are repaid on your own subsequent payday.

Common Credit score is owned by Upgrade, but focuses its financial loans a lot more directly on lousy-credit rating borrowers. Its origination charge is a tiny bit increased than Improve's, but Common Credit borrowers get use of a lot of Enhance's characteristics.

Lenders normally want your credit history score for being in at the very least the mid-600s. They'll also evaluate your credit rating historical past for feasible "red flags," which include late payments, individual bankruptcy, different new lines of credit rating, or maxing out your cards. Any of such can drastically hurt your chances of finding accepted to get a $two,000 private loan.

Mr. T Then & Now!

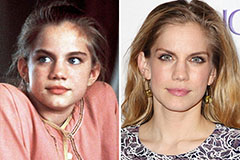

Mr. T Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!